JPMorgan’s Cash Position Continues To Grow

JPMorgan Chase & Company (NYSE: JPM) has been increasing its dividend at a robust 15% CAGR for the last few years and it looks like another big dividend increase is on the way. The company just released its fiscal Q3 earnings report and it included a much larger than expected release of capital reserves that only improved the dividend outlook. The company recently raised the dividend so we're not expecting an increase this quarter or even next quarter but we do see a high likelihood of future increases and robust double-digit increases at that. Considering that JPMorgan is America's leading banking institution and a high-quality dividend, to begin with, we think now could be a good time to buy some more shares.

JPMorgan Chase & Company Stumble On Mixed Results

JPMorgan reported satisfactory results but nothing to really get the market excited about. The company's $29.64billion in revenue is up 1.7% versus last year and up slightly versus the 2-year comparison but was only as expected in regards to the analyst estimates. On a system-wide basis, results were driven by gains in both average loans which are up 5%, and average deposits which are 9% but were offset by weaknesses in some other areas. In the community banking segment, for example, average loans are down 2% while average deposits are up 20%.

Moving down to the bottom line, the company produced strong earnings even without the addition of capital reserve releases. On a GAAP basis, the $3.74 beat the consensus by $0.74 but even the adjusted $3.02 beat the consensus estimate. The net benefit of consumer credit reserves totaled $1.50 billion compared to the $17 million expected by the analysts.

In regards to capital and capital allocation, the company is returning money to shareholders. JPMorgan netted a little more than $11.60 billion in earnings and used $8 billion of it for repurchases and dividends. The company repurchased $5 billion in shares during the quarter and paid $3 billion in dividends. The stock is yielding more than 2.4% with shares trading near $163 and we view this as a very safe payout. The payout ratio including capital releases is running well under 25% and only at 25% on an adjusted basis so there is ample room on the books for future increases while maintaining a strong tier 1 capital ratio.

The Analysts Are Bullish On JPMorgan

The analysts have yet to speak up in the wake of JPMorgan’s Q3 earnings report but the PriceTargets.com consensus estimate is overwhelmingly bullish. Of the 18 current ratings, 12 are a Buy or a Strong Buy with only one bear among them. The consensus price target of $168 implies only about 3.7% of upside but that doesn't include the 2.4% dividend yield or reveal the range of analyst expectations. Among the most recent activity are some price target upgrades that include the new high price target of $200 and another at $198 which together imply about 23% of upside is available for shareholders of the stock.

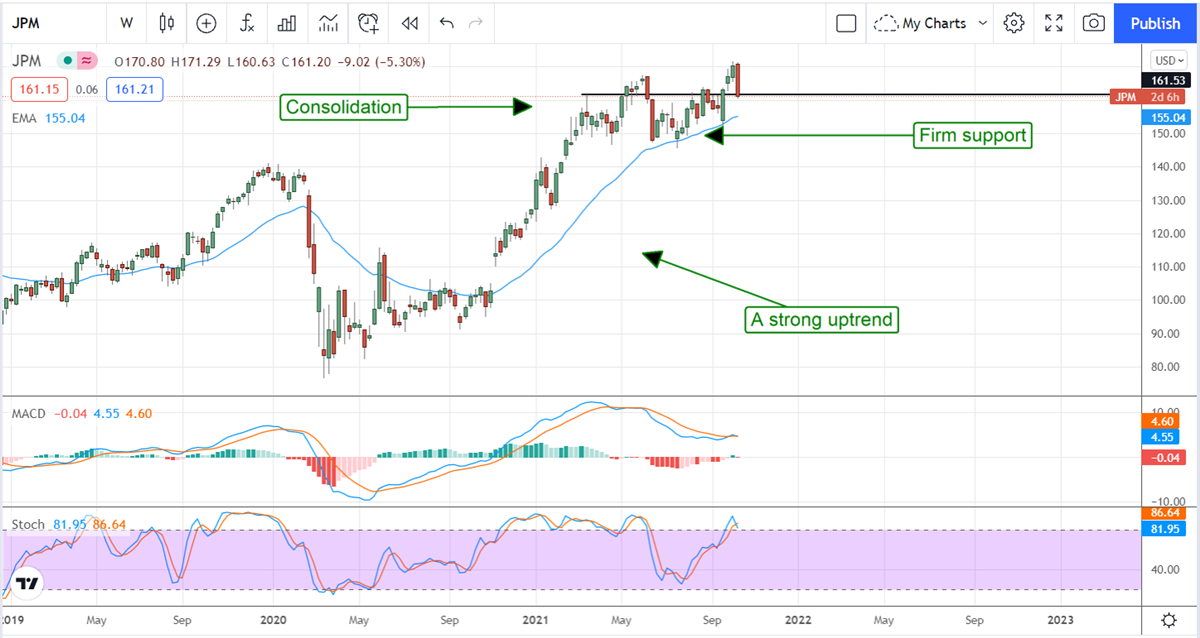

The Technical Outlook: JPMorgan Continues To Consolidate

Shares of JPMorgan are down a little more than 2.25% in the wake of the Q3 earnings report and may move lower In the near term. Key support is near the $150 level and the bottom of a consolidation range that we think will be broken within the next few quarters. In our view, economic expansion will continue to drive solid results for this company and share prices back to the top of the range. A firm move above the $170 level would be bullish and, when confirmed, could lead to as much as $80 or 50% of upside gains for investors.

Companies in This Article: